President John Dramani Mahama has said Ghana has survived without external borrowing from the capital market.

John Mahama quizzed who could’ve thought Ghana could be run by going to the external market to borrow.

According to Mahama, Ghana’s economy has been resilient without resorting to external borrowing.

He credited Ghana’s resilient economy to fiscal discipline and restructured spending for the turnaround.

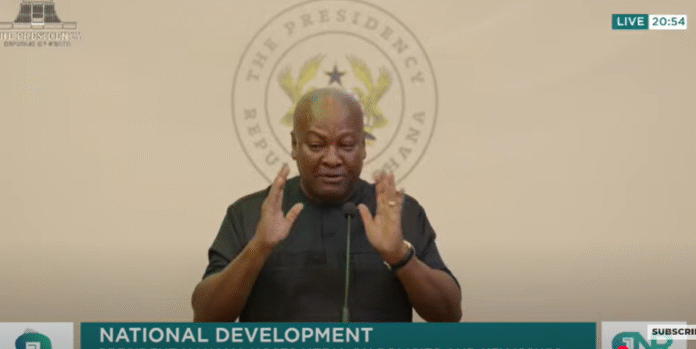

Speaking during his media encounter on Wednesday, September 10, John Mahama stated, “We are quite happy with the outcomes of the reforms that we have been implementing in the economy, and we have survived without going to the capital markets.

“We’ve survived without borrowing. Who could have thought some years ago that Ghana’s economy could be run without going to the external market to borrow, and yet we’ve survived,” he said.

Mahama further pointed to Ghana’s fiscal balance as evidence of progress.

“We’ve gone from negative 3.4% on the primary balance to positive 1.1% as at now. And by the end of the year, I’m sure we’ll overachieve the target of positive 1.5%,” Mahama added.

President Mahama, however, argued his government is not in a rush to go back to external borrowing despite improvements in the economic outlook.

He highlighted, “As the President, I would not favour a quick return to the international capital market. I think we should go like this for a while and consolidate the economy before we look at external financing”.

President Mahama also disclosed that the Bank of Ghana(BoG) has withdrawn its interventions in the foreign exchange market.

According to John Mahama, the move is to find the true value of the Ghanaian cedi against major trading currencies.

John Mahama stated, “And so yes, Bank of Ghana has been intervening in the forex market, but they’ve withdrawn. And what happened was that, because of the rapid appreciation in the value of the cedi, we saw an exponential increase in imports, because then people could buy cheaper dollars, and so they could import more, which is a natural economic phenomenon.

“But on the other side, exporters are not happy, because they get fewer cedis for what they export.”

John Mahama added that Ghana must strike a delicate balance between protecting exporters and importers.

He added, “And so every country tries to find out a balance where exporters are able to do good business and importers are not overburdened by high Forex, eh, rates? Where that lies? I don’t know. I’m not a central bank, but the cedis is making an adjustment, and I believe that it will settle at a certain rate, and we will make sure that any depreciation that occurs in the value of the cedis is within a margin of about 5% per annum. That is what we we target.”

President Mahama recalled, “There was one occasion where I said people were asking whether it will go below ¢10, and I said, it is dropping, but it will find its true value. It was undervalued at ¢16, and it probably is overvalued at 10, but somewhere between there we have the real value of the cedi.”

He connected part of the challenge to reduced inflows from abroad.

“It’s also seen that it coincided with a period where we saw a reduction of 50% in remittances, because citizens in the diaspora were taken aback by the rapid appreciation of the cedi.

“And so if somebody was building a house, if he was going to send $100,000, it meant that he was losing a certain percentage of that $100,000 and most of them would decide to adopt a wait-and-see attitude and say, Oh no, ask for cedis. It’s not possible that the cedi can regain its value to that extent.

By all means, it will go up again, so I’ll hold back my remittance until the cedi goes back up. So we saw a 50% reduction.”

“There were also some other factors. Some money transfer companies were collecting dollars abroad and not repatriating them.

He also revealed that investigations had uncovered disturbing practices.

President Mahama detailed, “There were other cases where people applied through the commercial banks for foreign exchange to cover imports, and those monies are transferred to pay for imports, but the imports never came into Ghana.

And we’ve studied for a period of four years. And every year over the period of four years, about $42 billion was taken out of this country without the corresponding imports coming into the country.

And so we started sanctioning some banks, and soon will start interrogating some individuals who ostensibly took money out against imports, but never brought those imports.”

He further emphasised the abuses that threaten the economy.

“We want to know what happened and if there was wrongdoing, to sanction whoever it is. While we work to stabilise our economy and improve the value of our currency, we must protect that currency, because a good, strong cedi is good for all of us.

“But when that happens, some people try to take advantage of it, and I think that we should all condemn anything like that”, Mahama added.